Deloitte forecasts annual luxury market growth between 5% and 10% until 2021

Merger and acquisition operations in the luxury industry have been increasingly frequent lately, from the recent purchase of Dries Van Noten by the Puig group, to that of Baccarat by Chinese investment fund Fortune Fountain Capital, the sale of Lancel to Piquadro and Missoni selling a stake to the Fondo Strategico Italiano investment fund. Despite the international economy’s complex outlook, this thriving M&A activity is boosting the confidence of investors who, according to a survey by consultancy firm Deloitte, forecast an annual growth between 5% and 10% in the fashion and luxury market from 2018 to 2021.

The third edition of Deloitte’s ‘Fashion & Luxury: Private Equity and Investors Survey 2018’ report indicated that growth is expected to rise even above 10% in the digital luxury goods and cosmetics and fragrances sectors, while apparel and accessories, watches and jewellery, the hotel and the furniture industries are expected to post annual growth rates between 5% and 10%.

Of the investors interviewed, 78% hold one or more assets in luxury and fashion. The survey confirmed the luxury sector is highly attractive, though a slow-down in M&A operations was noted, especially in terms of their size, which was significantly smaller than in the past: while the number of operations is growing, they are now less substantial. According to Deloitte, the average M&A deal value fell considerably, from $449 million in 2016 to $230 million a year later (down by 49%).

“Compared to 2017, the constant trend for consolidation in the fashion and luxury industry has an impact on investments, which are shifting (+10 percentage points) towards smaller-sized companies whose performance investors are looking to stimulate by deploying internationalisation strategies and introducing management changes,” said Lisa Lauv, M&A Transaction Services partners at Deloitte, in a press release.

In 2017, 217 M&A transactions were completed in the luxury goods market, six more deals than in 2016. In 2016 however, there were 70 more transactions than in the previous year. Specifically, 134 operations were completed in the personal luxury goods segment (5 more than in 2016), of which 77 were in the apparel and accessories sector (+8) and 28 in fragrances and cosmetics (+6). Only watches and jewellery posted a downturn in the number of transactions (29, compared to 38 in 2016).

Geographically, Europe is the only region in which the number of transactions increased (109 deals in 2017 vs 95 in 2016), chiefly thanks to the apparel and accessories sector (+9 deals). North America and Asia-Pacific recorded the same number of deals as in the previous year, respectively 59 and 36 transactions, though last year they were the leading regions.

“Investors are anticipating that Asian and Middle Eastern players will stimulate the industry's growth. The forecast for North America is positive (an annual growth rate between 5% and 10%) but the estimates are below those of 2017. Latin America will remain stable. For Japan, the outlook is better than what was expected last year, with investors envisaging an annual growth between 5% and 10%,” said Lisa Lauv.

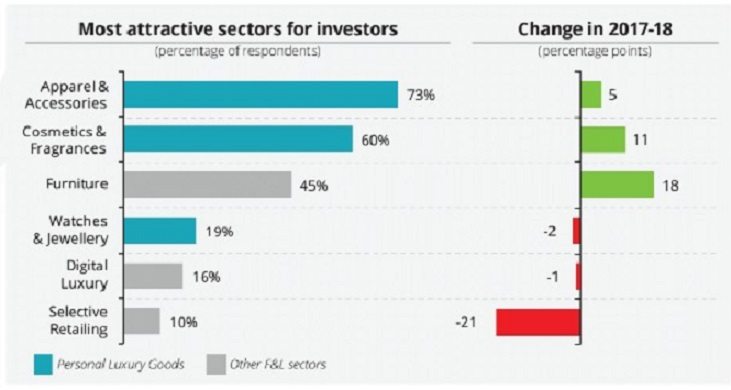

In 2018, 89% of investment funds are envisaging investing in the fashion and luxury sector, with a growing interest in apparel and accessories (in which 73% of them are trying it invest), while watches and jewellery have lost some of their appeal.

Copyright © 2024 FashionNetwork.com All rights reserved.